Whilst governments promote their aim of ‘getting life back to normal’ post Covid-19, a large number of reports on the pandemic and its effects on business, consumer behaviour and consumer sentiment have been published.

As these effects are likely to have a lasting impact, we look at some of the published statistics and the implications for brands and businesses as they go about finding, attracting and engaging with their target audiences post Covid-19.

Consumer statistics for 2020

- Over 85% of UK consumers shopped closer to home.[1]

- Over 79% UK consumers shopped online with a high degree of confidence.[2]

- 27% of UK consumers considered environmental impact of all or most of their purchases and over 74% chose environmentally friendlier, sustainable or ethically sound products despite the higher cost associated with them.[3]

- 38% of consumers indicated their future purchases would be influenced by what businesses or brands did to help people during the pandemic.[4]

- 39% of consumers have switched who they buy from and 88% will continue to buy from those brands.[5]

Consumer sentiment as Covid-19 lockdown eases

As lockdown restrictions have begun to ease, so consumer sentiment has seen some marked improvements. Pwc’s latest Consumer Sentiment Survey for Spring 2021 indicates that confidence in personal finances is at an all-time high and that consumers are ready to treat themselves by spending more on food, fashion and frivolity. This improvement in consumer sentiment will impact on all businesses not just retail businesses, so understanding which audience segments are leading the improvement can help businesses better adapt to the changes in audience demographic and dynamics. Some interesting statistics pulled from the Pwc survey include:

- Whilst usually the most negative group, the over 65s are now driving improved sentiment, scoring above all other age groups except amongst the 18-35s.

- Improvement in sentiment amongst the over 55s and over 65s is due in part to the positive effect of the roll out of the Covid-19 vaccine.

- All those between 35-45 are less positive than they were in March 2019.

- Regionally, London exhibits the most positive consumer sentiment at +22 on the Pwc scale, with all other regions falling below this figure.

So, what factors led to the changes and what are the implications?

Psychological factors have had as much to do with changes in consumer behaviour as external environmental factors. Below are the key psychological and physical factors behind the changed audience attitudes and behaviours.

Psychological influences

Prescribed and enforced judgements

As lockdown measures were introduced, governments added the new classification of ‘non-essential’ to a raft of businesses, to a wide range of products, and to many forms of travel.

Restrictions and penalties were introduced to enforce public acceptance and embed the classification in the minds of the general public.

Businesses had no option but to change their working practices. For individuals, daily routines, personal/peer connections and support networks were severely disrupted.

General consensus around major issues given voice in the public domain.

Issues like climate change that have been increasingly brought to the public’s attention and driven a rise in ethical purchasing. Added to this, is the emphasis given to supporting the NHS during the pandemic. Brands or stores that were seen to be supporting the vulnerable and the NHS in particular make up 31% of all ethical purchasing[6].

Behavioural psychology and habit forming

Health psychology researcher Phillippa Lally undertook research at University College London based on a finding published in 1960 by plastic surgeon Maxwell Maltz who found that it took patients a minimum of 21 days to adjust to a new situation such as the amputation of a limb. Her research team wanted to see how long it took for a person to form a habit. Their research found that it took between two to eight months for new habits or behaviours to become embedded and automatic.

The implications for brands/businesses

The first issue for many businesses or brands will be how they deal with having been classified as ‘non-essential’ as this negative term has had ample time (in behavioural psychology terms) to become associated with their brand or business in customers’ minds.

The next issue will be how they address wider society concerns such as climate change, or how they look after their people or their local communities, particularly during the Covid-19 pandemic. The McKinsey Global Institute Briefing note #52 published on April 28, 2021 states that the implication of issues relating to consensus views require businesses to include them as a core concern within their mission statements. They should adopt ‘stakeholder capitalism’ and define their mission as creating long-term value not only for shareholders but also for customers, suppliers, employees, communities, and others.

Physical factors

The interesting thing about physical or environmental factors affecting purchasing behaviour is that they have a fairly predictable knock-on effect from one to another.

From an audience engagement perspective, they also create new challenges for how brands engage or communicate with both their internal and external audiences.

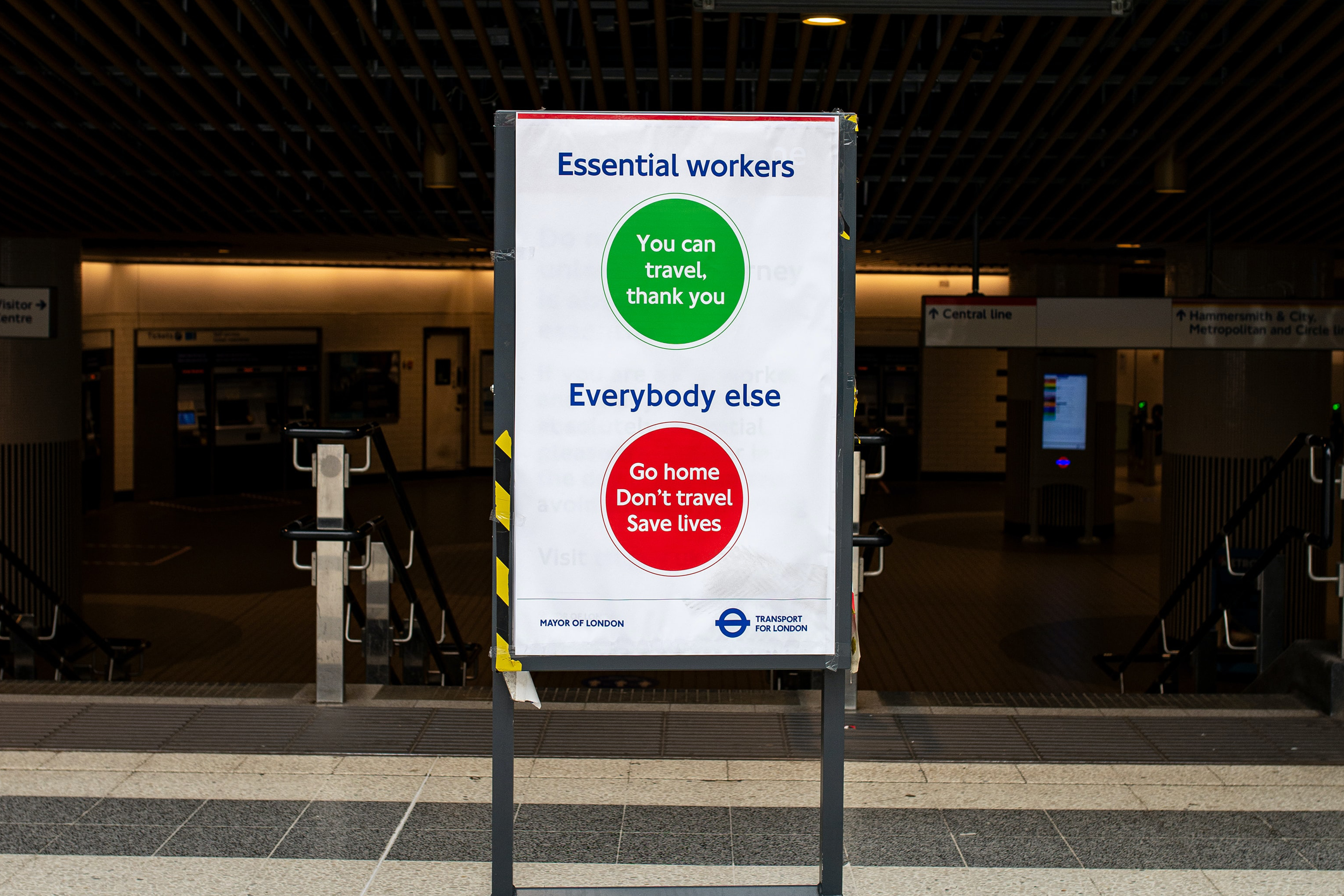

Travel restrictions and remote working

Restrictions placed on travel to and from work during the pandemic has seen a dramatic increase in employees working from home.

McKinsey Global Institute report – The future of work after Covid-19 published in February 2021 showed that about 20 to 25 percent of the workforces in advanced economies could work from home between three and five days a week.

This represents four to five times more remote work than before the pandemic and could prompt a large change in the geography of work as companies shift out of large cities or expensive office premises into smaller premises or to the suburbs or smaller cities.

Relocation of workforce

In June and July 2020, the number of buyer inquiries made to Rightmove, the UK’s largest online property website, from people living in 10 cities increased by 78% compared with the same period in 2019. There was also a 126% increase in people considering properties in village locations. The pandemic exposed shortcomings with people’s living arrangements with many wanting more indoor and outdoor space as they work from home.

Increased adoption of digital channels

With travel restrictions in place and many businesses prevented from providing 1 to 1 contact with customers, consumers moved to purchasing online. E-commerce in the UK grew 4.5 times faster than before the Covid-19 pandemic.[7]

In April 2020 Kantar published its findings on consumer media consumption which showed increases across all in-home channels. Web browsing increased by 70%, TV viewing increased by 63% and social media engagement was up by 61%.

A rise in the importance of social media platforms in the decision-making process was found[8] with more than half (51%) of millennials stating that they source recommendations from social networks, and 48% watch influencer unboxing videos.

The implications for brands/businesses

Access to audiences

When people no longer travel en-masse to and from work via major transport hubs brands are presented with a major challenge in how they get the public’s attention.

For example, TfL (Transport for London) which also happens to have moved into the advertising game, saw ad revenue from their tube network, bus T-side advertising and bus shelter estate (operated by JCDecaux) collapse by 90% year on year[9] as a direct result of the pandemic. In comparison, OOH (Outside of home) advertising in the UK regions and for roadside panels is recovering more quickly and showing above normal activity as advertisers follow their audiences’ movements.

Communication with audiences

Clearly brands and businesses need to review their communication strategies and develop an omnichannel approach that matches the more complex nature, routines and locations of their audiences post Covid-19.

They need to: Identify where, when and how their audiences gather information to aid in their purchasing decisions; what importance they ascribe to both offline and online sources of information when forming their opinions; and what aspects of their online experience impacts on their opinions about a brand or business.

[1] European Commission Consumer survey on impact of Covid-19, 12 March 2021

[2] European Commission Consumer survey on impact of Covid-19, 12 March 2021

[3] European Commission Consumer survey on impact of Covid-19, 12 March 2021

[4] Global webindex Coronavirus Research published in April 2020

[5] European Commission Consumer survey on impact of Covid-19, 12 March 2021

[6] Pwc Consumer Sentiment Survey – May 2020

[7] McKinsey Global Institute report – The future of work after Covid-19 – Feb 18 2021

[8] Bazaarvoice,“Behavior that sticks, August 10, 2020. https://www.bazaarvoice.com/resources/behavior-that-sticks- understanding-the-long-term-shopping-trends-driven-by-covid-19

[9] The McKinsey Global Institute Briefing note #52 published on April 28, 2021